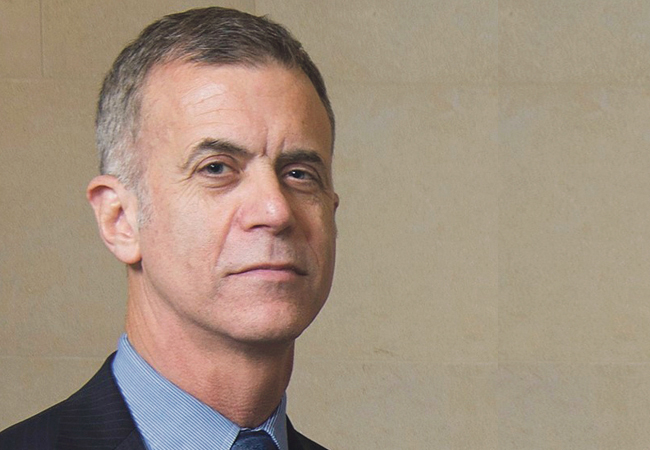

Economist Eugene N. White has accepted the 2023 summer semester visiting professorship sponsored by Bankhaus Metzler and the Friedrich Flick Förderungsstiftung.

Knowledge of financial history is virtually indispensable not just for established finance experts, but also for finance students. That was the motivation for setting up the Financial History Visiting Professorship at Goethe University Frankfurt in 2014, which remains highly topical in the current times of ongoing instability and accelerated change in the financial system. Sponsored by Bankhaus Metzler and the Friedrich Flick Förderungsstiftung, the visiting professorship once again was prominently staffed in the 2023 summer semester with Eugene N. White, economist and financial historian at Rutgers University, New Jersey, USA. Lectures and an international conference organized together with the House of Finance, the Leibniz Institute SAFE, and the Institute for Banking and Financial History also appealed to the general public. Thanks not least to Eugene N. White’s great curiosity, the intensive exchange of ideas during the visiting professorship is likely to generate numerous new ideas for future projects – something the two sponsoring institutions are also pleased about. They recently agreed to extend their support for the further expansion of the financial history research network that has emerged around the Frankfurt Visiting Professorship in recent years.

Below, the renowned scholar outlines some of his research foci in the context of US financial history.

„I am convinced by the financial history approach because it offers a longer-term perspective on the rapid changes in financial markets and institutions,“ White says. Using such an approach, students gain an understanding of how data change as institutions evolve, and learn to ask critical questions informed by both the past and the present. „The best argument in favor of financial history is that financial crises are rare events, and are usually met with the response that ‚this time everything is different‘, or – once new rules and regulations have been put in place in response to the crisis – that ‚it can never happen again.'“ While writing his doctoral thesis in economics at the University of Illinois-Urbana, White also studied the deposit insurance policy innovation, which received much attention in the United States. Oddly enough, despite earlier experience with the associated moral hazard risks, the US in fact introduced deposit insurance. In the wake of the 1907 Bankers’ Panic, in response to which the federal government set up the Federal Reserve central bank, seven states had each established state deposit insurance systems, all of which had gone bankrupt by the late 1920s as a result of the excessive risk-taking this triggered.

White wondered why, despite such flaws, the Federal Deposit Insurance Corporation (FDIC) was established as a government-run system in 1933. Further research revealed that demand for deposit insurance dated as far back as the 1890s, with relevant draft legislation for guarantee plans submitted to Congress. The regional origins reveal a political fact that applies both to the FDIC as well as all earlier deposit insurance systems: Contrary to textbook opinion, deposit insurance was not the product of a shrewd government attempting to address public fears of bank failures. Instead, it was the result of a concerted effort by smaller regional banks to hold their own against the big banks, which, by virtue of their size and diversification, were able to insure themselves against losses. Neither the US president, nor the Federal Reserve, or for that matter the big banks or the leading economists were in favor of the FDIC. In the end, however, they waved through its creation because they needed the support of the small banks for other reform plans. White’s research also showed that after the FDIC’s establishment, the share of insured deposits increased, covering all financial intermediaries, whose losses were thus ultimately socialized.

„While Americans are unlikely to simply abandon a program that shifts responsibility for identifying and cleaning up risky banks to the government, the World Bank found my study’s findings useful when it comes to persuading developing countries to defer or limit their own deposit insurance schemes,“ White says. By contrast, during the onset of the Savings and Loan crisis beginning in the late 1970s, savings and loan associations in the US found an open ear for their plea for a state deposit insurance fund in state legislators. Two funds collapsed as quickly as the deposit insurance systems put in place after 1907. „Hoping to dissuade other states from planning similar safety-net systems, I explained in an article published in the Wall Street Journal the historical and contemporary evidence showing that such measures carry the seeds of their own demise from the outset,“ White recalls.

»People assumed the stock market crash of 1929 could never happen again«

„Similar to deposit insurance, the Glass-Steagall Act, which prohibited a bank from combining commercial and investment banking, also enjoyed a good reputation. The at times theatrically and repeatedly presented evidence in congressional hearings focused on the claim that ‚universal banks‘ had profited from the exploitation of conflicts of interest to the detriment of their customers, and helped trigger the Great Depression. I was suspicious of these theories, which are based on a few anomalous examples. After having compiled the relevant data, I went on to publish the first economic study proving that universal banks were not a cause of financial instability,“ White says, adding that, „they were in fact found to be less risk-averse and also exhibited fewer bankruptcies. Research by other scholars later substantiated that Congress‘ other claims were wrong, too. When a repeal of the Glass-Steagall Act was debated, and critics claimed this would raise the cost of financial services, several investment banks, including J.P. Morgan, discussed my seminal paper, which also ended up being presented twice in congressional hearings. The law was eventually struck down in 1999.“ During the 2007-2008 financial crisis, many pundits blamed the repeal of the Act as a key trigger, but White says it was relatively easy for him to defend the repeal, pointing out that it was the more traditional, stand-alone investment banks that stood at the center of the crisis, not the newly created universal banks.

White recalls that there was so much faith in the corrective measures taken as part of the New Deal that people assumed the stock market crash of 1929 could never happen again – until the stock market crashed again in October 1987. „I wondered if anyone had applied modern methods of financial analysis to analyze the stock market crash at that time. It turned out that the last work that had shaped the views of both the public and the experts was John Kenneth Galbraith’s The Great Crash 1929, written in 1954, the year the Dow Jones index returned to its 1929 peak. In his best-selling book, Galbraith blamed the crash on what was later described as irrational exuberance on the part of the public, as well as the abundance of credit extended by banks to stockbrokers and the gullible public. The lack of statistical evidence left me puzzled, and I proceeded to compile the available data to determine the causes of the boom and bust in the stock markets. My research showed that there was no evidence that the market had been driven by credit. In addition, while fundamentals certainly accounted for part of the boom, there was a bubble on top of it. It was credit demand from the wild-eyed herd that caused lenders to double down on collateral and raise interest rates. I brought together financial scientists and historians and organized a ‘One-Year-After-Crash Conference’, which helped ensure that the reforms introduced in response to the 1987 crash were much more measured compared to 1929.”

Finally, White points to the 2008 burst of the huge housing bubble, which had far more devastating consequences. „It seemed as though there was no precedent to draw on. Then I remembered a crisis that occurred in the 1920s but which had been largely forgotten – for good reason. Although the rise in real estate prices appeared to have been of a similar magnitude, the damage was less severe. The reason for this was that the lending financial institutions had not leveraged themselves in the 1920s, which greatly reduced the risk of insolvency and panic. A conference of US and European researchers that I subsequently organized on behalf of the National Bureau of Economic Research showed that there were institutional structures that could better cope with the ups and downs of asset bubbles.“ Panics and crashes, the economist concludes, are the much-cited black swans of the financial world. „They are rare, but if we want to understand when and why they occur, we can’t afford to ignore historical crises and those that have occurred in other countries.“

Hanna Floto-Degener

executive director of the House of Finance